Electrification of Transportation: How the 2026 Economy Is Being Rewired

Electrification as a Structural Business Shift

By 2026, the electrification of transportation has moved decisively from a forecast to a structural reality, reshaping how industries operate, how capital is allocated, and how competitive advantage is defined across global markets. What began as a niche movement led by early adopters and a handful of innovators has matured into a mainstream transition that now touches automotive manufacturing, energy, logistics, retail, finance, and digital technology. For the global business community that turns to Business-Fact for strategic insight, electrification is no longer a future scenario to be monitored; it has become a present-day operating condition that must be actively integrated into corporate strategy, risk management, and long-term investment planning.

Unlike many historic technology shifts that were driven primarily by either regulation or innovation, the current wave of electrification is powered simultaneously by policy mandates, rapid technological progress, and capital markets that increasingly favor low-carbon business models. Governments across Europe, North America, and Asia have set binding timelines to phase out new internal combustion engine (ICE) vehicles, while companies such as Tesla and BYD demonstrate that large-scale electric vehicle (EV) production can be commercially viable and, in some segments, more profitable than legacy models. Learn more about the policy context for zero-emission vehicles through the European Commission's climate and energy framework.

For enterprises, this evolution is not merely an environmental adjustment or a branding exercise; it represents an economic realignment in which sustainability is embedded into operational decisions, capital expenditure, and product design. On Business-Fact's sustainable business hub, this alignment is increasingly visible as sustainability becomes a measurable driver of cost efficiency, risk reduction, and revenue growth, rather than a discretionary corporate social responsibility initiative.

Regulatory Forces: Mandates as Market Makers

Regulation has become one of the most powerful catalysts behind transportation electrification, effectively transforming climate goals into hard market signals. The European Union's decision to require zero emissions from new cars and vans by 2035 forces automakers and suppliers to reconfigure product roadmaps, production assets, and R&D portfolios on an accelerated timeline. Details of these rules can be reviewed via the European Parliament's legislative updates, which now serve as a reference point for regulators in other regions.

In the United States, the Inflation Reduction Act (IRA) and complementary state-level policies have combined purchase incentives for EV buyers with production-linked tax credits for battery manufacturing and critical mineral processing, encouraging both domestic and foreign automakers to localize supply chains. Businesses seeking to understand the broader macroeconomic impact can examine analysis from the U.S. Department of Energy and the U.S. Environmental Protection Agency, which detail both emissions benefits and grid implications.

China, meanwhile, has consolidated its position as the leading EV market, accounting for the majority of global EV sales and using industrial policy to elevate domestic champions such as BYD and NIO into global competitors. The country's New Energy Vehicle (NEV) mandate, combined with aggressive infrastructure expansion, offers a case study in how coordinated policy, industrial capacity, and consumer incentives can rapidly reshape a market. For readers of Business-Fact's global business coverage, China's EV strategy illustrates how state-backed industrial ecosystems can redefine international competition.

Regulations in pioneering markets such as Norway, where EVs dominate new car sales, also serve as early indicators of the end-state of electrification. Data from the Norwegian Road Federation show how targeted incentives, robust charging infrastructure, and predictable policy signals can push EV penetration to levels once considered unattainable. For multinational firms, the message is unambiguous: aligning product and investment strategies with these regulatory trajectories is not optional; it is a prerequisite for continued access to key markets.

Technology Breakthroughs and the New Economics of EVs

The economic viability of electrification has been profoundly shaped by advances in battery technology and power electronics. Over the past decade, the cost per kilowatt-hour of lithium-ion batteries has fallen dramatically, while energy density and cycle life have improved, making EVs cost-competitive with ICE vehicles in many segments. Organizations such as CATL, Panasonic, and LG Energy Solution have scaled production and pursued next-generation chemistries, including solid-state and high-manganese designs, which promise faster charging and longer range. Analysts can track these cost and performance trends via the International Energy Agency, which now treats EVs as a central pillar of the global energy transition.

Automakers across premium and mass-market segments have responded by committing to all-electric futures or at least heavily electrified product portfolios. Volvo Cars has reiterated its ambition to become a fully electric car company, while Mercedes-Benz and BMW continue to expand their high-end EV offerings, integrating advanced driver assistance, over-the-air updates, and sophisticated infotainment systems. These vehicles are increasingly defined by software and connectivity rather than purely mechanical performance, a shift that aligns with the themes covered in Business-Fact's innovation section.

Commercial and fleet segments have also been transformed. Amazon has rolled out large fleets of electric delivery vans developed with Rivian, while logistics operators in Europe and North America deploy electric trucks and e-cargo bikes for last-mile delivery. Companies such as ABB have become critical enablers through high-capacity charging solutions, as outlined on ABB's EV charging portal. For technology providers, this creates a multi-layered opportunity in charging hardware, grid integration, fleet management software, and AI-enabled optimization.

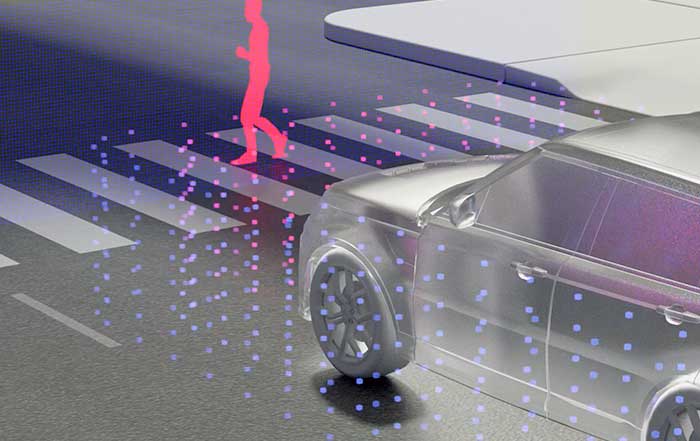

The EV is now best understood as a rolling digital platform, rich in sensors and data, and tightly integrated with cloud services and artificial intelligence. This convergence opens new value pools in predictive maintenance, data monetization, and autonomous driving, which are closely aligned with the themes explored on Business-Fact's artificial intelligence page. Companies that can integrate hardware, software, and services into a coherent ecosystem are emerging as the most competitive players in the new mobility landscape.

Automotive Value Chains Under Reconstruction

Electrification has fundamentally altered where value is created and captured within the automotive supply chain. Traditional ICE vehicles required complex assemblies of engines, transmissions, exhaust systems, and fuel delivery components, with a large ecosystem of tier-one and tier-two suppliers. In contrast, EVs concentrate value in batteries, power electronics, semiconductors, and software, thereby elevating the strategic importance of battery manufacturers and chip suppliers while compressing the role of some legacy component providers.

Strategic moves by leaders in the sector illustrate this reconfiguration. Tesla's long-standing collaboration with Panasonic, BYD's vertically integrated Blade battery platform, and Volkswagen's multi-billion-euro investments in gigafactories all reflect a drive to secure long-term access to critical technologies and materials. Businesses tracking these developments can reference the World Bank's reports on critical minerals to understand how lithium, cobalt, nickel, and rare earths have become central to industrial policy and corporate risk management.

The shift has profound implications for suppliers. Companies that once specialized in ICE-related components are diversifying into e-motors, inverters, thermal management systems, and lightweight composite structures. Those unable to pivot face shrinking addressable markets and margin compression. For investors and readers of Business-Fact's stock markets coverage, earnings calls and capital expenditure announcements in this sector now serve as leading indicators of which suppliers will remain relevant in an electrified future.

Recycling and circularity are emerging as strategic capabilities within this reconstructed value chain. As first-generation EV batteries approach end of life, companies specializing in battery recycling are building processes to recover lithium, nickel, and cobalt at scale, reducing dependence on volatile primary mining and supporting corporate sustainability goals. Detailed perspectives on the circular economy dimension can be found via the Ellen MacArthur Foundation, which highlights how closed-loop systems can mitigate supply risk and reduce environmental impact.

New Mobility and Service-Based Business Models

The electrification wave has not only changed the hardware of mobility; it has enabled new business models that move beyond traditional vehicle ownership. Subscription-based services, flexible leasing, and mobility-as-a-service (MaaS) platforms are proliferating across major cities in Europe, North America, and Asia, reflecting changing consumer preferences and the economics of EV fleets. Chinese manufacturer NIO, for example, offers battery-as-a-service and battery swapping, decoupling the most expensive component from the vehicle and creating recurring revenue streams that resemble software subscription models. Details of these initiatives are available on NIO's corporate site.

Automakers increasingly position themselves as integrated service providers, offering digital services, connectivity packages, and over-the-air feature upgrades. Tesla's paid driver-assistance packages and connectivity subscriptions, as well as similar offerings from BMW and Mercedes-Benz, exemplify a shift from one-time sales to lifetime revenue relationships based on data and software. This evolution mirrors the transformation of other industries documented in Business-Fact's broader business analysis, where recurring revenue and platform strategies have become hallmarks of high-valuation companies.

Urban authorities and mobility platforms are also experimenting with integrated ticketing and multimodal services, where EV car-sharing, e-scooters, and public transit are bundled into unified digital platforms. Reports from organizations such as McKinsey & Company outline how these models can reduce congestion and emissions while opening new data-driven revenue streams for both public and private actors.

Charging, Retail Integration, and Energy Convergence

The rapid expansion of charging infrastructure has become a defining feature of the electrification era, creating new intersections between transportation, retail, and the energy sector. Oil and gas majors such as Shell and BP are rebranding parts of their networks around EV charging, with Shell Recharge and BP Pulse increasingly visible across Europe, North America, and Asia. These companies are not simply adding chargers; they are repositioning themselves for a post-fossil-fuel landscape, a trend explored in depth by the International Renewable Energy Agency.

Retailers and commercial property owners have recognized that EV charging can drive foot traffic and dwell time. Chains such as Walmart, Target, IKEA, and large shopping malls are partnering with charging providers to install fast chargers in parking lots, often powered by on-site solar or renewable energy contracts. For businesses focused on customer experience and brand differentiation, charging becomes both an amenity and a symbol of climate commitment, aligning with the marketing and positioning strategies discussed on Business-Fact's marketing insights page.

For utilities and grid operators, the proliferation of EVs presents both opportunities and challenges. On the one hand, EV charging increases electricity demand, potentially boosting revenues and justifying new grid investments; on the other, unmanaged charging can stress local distribution networks. Vehicle-to-grid (V2G) technologies, which allow EVs to provide power back to the grid during peak periods, are being tested in pilot projects across Europe, the United States, and Asia, with early results documented by the U.S. National Renewable Energy Laboratory. Over time, V2G and smart charging could transform EVs into distributed energy assets that enhance grid stability and enable higher penetration of variable renewables.

Logistics, Freight, and Global Supply Chains

Electrification is reshaping logistics and freight operations, especially in urban and regional segments where range requirements align well with current battery capabilities. Large global operators such as Amazon, UPS, and DHL have adopted electric delivery vans and e-cargo bikes to meet emissions regulations and lower total cost of ownership. Many cities in Europe and parts of Asia have introduced low-emission or zero-emission zones, effectively requiring electric or hybrid vehicles for last-mile deliveries. Businesses that fail to electrify fleets risk losing access to high-value urban markets, a dynamic that is increasingly central to discussions of competitiveness on Business-Fact's global business pages.

Heavy-duty transport remains more complex. Long-haul trucking, aviation, and deep-sea shipping face significant challenges due to energy density constraints and infrastructure requirements. Companies such as Hyundai and Toyota are experimenting with hydrogen fuel cell trucks, while shipping companies like Maersk are investing in methanol and other low-carbon fuels. Aviation stakeholders, supported by initiatives highlighted by the International Air Transport Association, are pursuing sustainable aviation fuels and hybrid-electric propulsion concepts. For diversified logistics and industrial firms, the strategic imperative is to maintain a portfolio of technologies, hedging against uncertainty while ensuring compliance with tightening climate regulations.

Workforce, Skills, and Employment Transformation

The human capital dimension of electrification has become increasingly visible as companies confront the need to reskill and redeploy large segments of their workforce. The shift from mechanical complexity in ICE vehicles to electronic and software-centric EV architectures requires new competencies in battery chemistry, power electronics, embedded systems, cybersecurity, and data analytics. The International Labour Organization (ILO) and other bodies have projected that while jobs in traditional engine and exhaust manufacturing will decline, new roles in battery production, charging infrastructure deployment, and renewable energy integration will expand, particularly in regions that successfully attract gigafactory investments and associated ecosystems. Broader employment implications are explored in Business-Fact's employment section.

In Germany, for example, Volkswagen and other automakers have launched extensive retraining programs to transition assembly workers toward battery module assembly and high-voltage systems. In the United States, Ford and General Motors have announced training initiatives tied to their new EV and battery plants, often in partnership with community colleges and technical institutes. In China, BYD continues to expand its in-house workforce, integrating battery, semiconductor, and vehicle production under one corporate umbrella. These initiatives highlight a broader trend: companies that treat workforce transition as a strategic investment rather than a compliance obligation are more likely to maintain productivity and social license as electrification advances.

Independent repair shops and aftermarket service providers also face a skills inflection point. EVs typically require less routine maintenance than ICE vehicles, but they demand specialized expertise in diagnostics, software updates, and high-voltage safety. Training programs supported by industry associations and public agencies, such as those documented by the European Automobile Manufacturers' Association, are beginning to address these gaps, but the pace of change remains a concern for policymakers and business leaders alike.

Capital Flows, Markets, and Investment Strategy

From a capital markets perspective, transportation electrification has become one of the defining megatrends of the 2020s, attracting hundreds of billions of dollars in investment across vehicle manufacturing, batteries, charging networks, and enabling technologies. The International Energy Agency estimates that global investment in EVs and associated infrastructure surpassed half a trillion dollars in the first half of the decade, a figure that continues to grow as institutional investors align portfolios with net-zero commitments. Readers seeking a broader macro-financial context can refer to the IMF's climate finance research.

Stock markets have consistently rewarded companies with credible and ambitious electrification strategies. Tesla and BYD have seen substantial market capitalizations, reflecting both first-mover advantage and investor belief in their integrated hardware-software models. Traditional automakers that have articulated clear EV roadmaps and backed them with capital expenditure are being re-rated, while those perceived as lagging face valuation discounts. For investors who follow Business-Fact's stock markets insights, EV-related announcements have become critical signals in portfolio construction.

ESG (Environmental, Social, and Governance) criteria now play a central role in capital allocation, and electrification is often a core component of climate-aligned investment strategies. Sovereign wealth funds in Norway, Singapore, and the Middle East, along with major pension funds in Canada, Australia, and Europe, have increased exposure to battery manufacturers, renewable energy developers, and EV-focused infrastructure funds. At the same time, alternative financing mechanisms are emerging: tokenization projects and digital asset platforms, as covered in Business-Fact's crypto section, are experimenting with fractional ownership of charging networks and fleet assets, expanding participation beyond traditional institutional investors.

Consumer Perception, Branding, and Market Positioning

Electrification is as much a branding and customer experience challenge as it is a technological or regulatory one. Companies must convince consumers and fleet operators that EVs are not only environmentally preferable but also reliable, convenient, and aspirational. Tesla has successfully positioned its vehicles at the intersection of high performance, cutting-edge technology, and environmental consciousness, while Volvo Cars emphasizes safety, design, and its commitment to an all-electric future. BMW and Mercedes-Benz leverage their heritage in luxury and engineering to make EVs status symbols, whereas BYD emphasizes value, range, and domestic innovation to capture mass-market share in China and increasingly abroad.

Non-automotive brands are also leveraging electrification in their marketing narratives. Retailers that offer charging services, energy companies that promote renewable-powered charging, and technology firms that enable smart charging all seek to associate themselves with a cleaner, more innovative future. For marketing leaders following Business-Fact's marketing analysis, the lesson is clear: electrification can be a powerful differentiator when integrated authentically into brand strategy, supported by transparent data and tangible customer benefits.

Consumer acceptance is further influenced by information quality and trust. Resources such as the U.S. Department of Energy's Alternative Fuels Data Center and the UK's Office for Zero Emission Vehicles help demystify EV ownership, charging, and incentives, reducing perceived risk and addressing misconceptions. Businesses that align their messaging with such authoritative sources enhance credibility and reduce friction in the customer decision journey.

Regional Dynamics and Competitive Positioning

Electrification is proceeding at different speeds and with varying business models across regions, creating a complex competitive landscape. In the United States, a combination of federal incentives, state-level mandates, and private investment is driving rapid expansion of EV manufacturing in the so-called "battery belt," stretching across the Midwest and the South. Companies such as Ford, GM, and Hyundai are building large EV and battery facilities, while charging networks expand along highways and in major metropolitan areas. These developments intersect with broader trends in reshoring and industrial policy, frequently analyzed in Business-Fact's economy coverage.

In Europe, markets such as Germany, Norway, the Netherlands, and the United Kingdom are at the forefront of adoption, supported by stringent emissions regulations, dense charging networks, and high environmental awareness. European automakers, including Volkswagen, Stellantis, BMW, and Mercedes-Benz, are racing to maintain market share both at home and in export markets, while facing increasing competition from Chinese EV manufacturers. Policymakers and businesses alike are monitoring trade dynamics and potential tariff measures through institutions such as the World Trade Organization.

In China, the combination of industrial policy, scale, and a highly competitive domestic market has created a powerful EV ecosystem that now exports vehicles to Europe, Southeast Asia, South America, and the Middle East. In Japan and South Korea, incumbents such as Toyota, Honda, Hyundai, and Kia balance battery-electric vehicles with hybrids and hydrogen technologies, reflecting a diversified approach to decarbonization. Emerging markets in Brazil, Thailand, South Africa, and India are gradually accelerating adoption through localized production and targeted incentives, often with support from Chinese or European partners.

For global enterprises and investors, these regional differences underscore the need for nuanced strategies rather than uniform global rollouts. Product portfolios, pricing, infrastructure commitments, and partnership models must be tailored to local regulatory, economic, and cultural conditions. The ability to orchestrate such differentiated strategies across continents is emerging as a key determinant of long-term competitiveness in the electrified economy.

Technology, AI, and the Future Mobility Ecosystem

As EV penetration increases, the boundary between automotive, technology, and energy sectors continues to blur. Automakers are developing in-house software platforms or partnering with technology firms to deliver connected services, autonomous driving capabilities, and integrated energy management. Systems such as BYD's DiLink, Tesla's Autopilot and Full Self-Driving, and Volvo's Android-based infotainment illustrate how vehicles are evolving into sophisticated computing devices on wheels. These developments align closely with the themes of digital convergence and AI-driven transformation explored in Business-Fact's technology coverage.

Artificial intelligence plays a growing role in optimizing charging patterns, predicting component failures, enabling advanced driver assistance, and orchestrating fleets for logistics and ride-hailing. Cloud providers and chipmakers have entered the mobility value chain as critical partners, offering edge computing, data analytics, and specialized processors for autonomous driving. Organizations such as the World Economic Forum have begun to frame this convergence as the emergence of a new mobility ecosystem, where data, energy, and transport infrastructure are tightly interlinked.

For businesses, this convergence creates both opportunities and new categories of risk. Cybersecurity, data governance, and interoperability become strategic concerns, while regulatory scrutiny around autonomous driving and data privacy intensifies. Companies that can integrate AI and digital capabilities into their electrification strategies, while maintaining strong governance and compliance frameworks, are better positioned to build trust and capture value in this evolving ecosystem.

Strategic Implications for Business Leaders

For the global business audience that relies on Business-Fact to navigate structural change, electrification of transportation is best understood as a cross-cutting transformation that affects capital allocation, supply chain design, workforce planning, product strategy, and brand positioning simultaneously. It is not a trend that can be delegated to a single department or treated as a marginal sustainability initiative; it demands board-level attention and integrated execution across the enterprise.

Leadership teams must evaluate exposure and opportunity across the full spectrum of their operations: assessing how regulatory trajectories in key markets will affect demand; determining whether existing supply chains are resilient in a world of constrained critical minerals; ensuring that workforce capabilities are aligned with the electronics and software-centric future of mobility; and identifying partnerships with utilities, technology providers, and infrastructure operators that can accelerate their transition. Insights from Business-Fact's banking, investment, and news sections can help contextualize these decisions within broader financial and geopolitical dynamics.

Companies that move decisively-embedding electrification into core strategy, investing in innovation, and aligning with evolving regulatory and consumer expectations-are likely to emerge as leaders in the next phase of global competition. Those that treat electrification as a narrow compliance issue or delay adaptation risk being marginalized as markets, investors, and customers converge around an increasingly electrified and digitally integrated transportation system.