How Data Analytics Is Powering Business Innovation in 2026

Data at the Strategic Core of Global Business

By 2026, data analytics has become an indispensable strategic asset at the heart of modern enterprises, shaping how organizations compete, innovate and build resilience across global markets. For the international readership of Business-Fact.com, which spans executives, founders, investors and policymakers from North America, Europe, Asia-Pacific, Africa and Latin America, data analytics is no longer perceived as a technical adjunct or a back-office reporting function. It is now recognized as a defining capability that underpins value creation in banking, manufacturing, technology, retail, healthcare, logistics and digital platforms alike. Whether in New York, London, Frankfurt, Singapore, Tokyo, Sydney, São Paulo or Johannesburg, leaders increasingly understand that the ability to transform raw data into timely, trustworthy and actionable insight is what separates tomorrow's market leaders from those that will struggle to adapt.

From the editorial vantage point of Business-Fact.com, which regularly examines business transformation, stock markets, employment trends and global economic shifts, data analytics is seen as the connective tissue between digital technology and tangible financial outcomes. Board agendas in the United States, the United Kingdom, Germany, Canada, Australia and across Asia now routinely feature data strategy alongside capital allocation, risk management, sustainability and talent planning. At the same time, regulators in the European Union, the United States, China, Singapore and other jurisdictions are tightening expectations around data governance, privacy, algorithmic accountability and AI safety, making experience, expertise, authoritativeness and trustworthiness in data analytics a core requirement for credible leadership rather than an optional enhancement.

The Maturation from Descriptive to Predictive and Prescriptive Intelligence

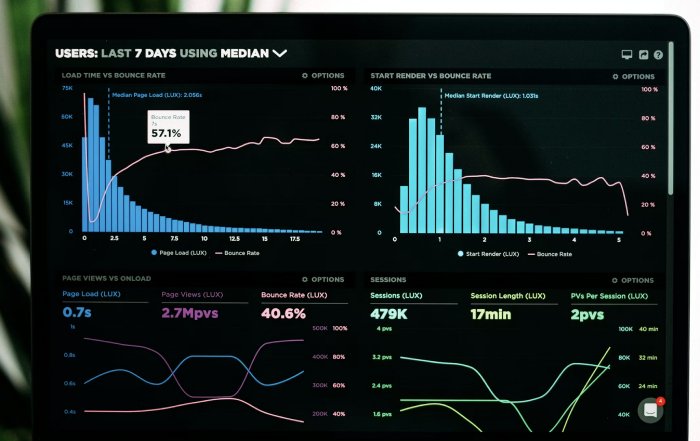

The progression of analytics over the last decade has been marked by a steady shift from hindsight to foresight and, increasingly, to automated decision support. Many organizations initially concentrated on descriptive analytics, deploying dashboards and business intelligence tools to understand historical performance. While these capabilities remain essential for compliance, reporting and baseline management, competitive advantage in 2026 is increasingly derived from predictive and prescriptive analytics, where advanced models forecast likely outcomes and recommend optimal actions at scale and in near real time. Leading advisory firms such as McKinsey & Company continue to outline how advanced analytics can unlock substantial productivity gains and margin expansion across sectors, and business leaders are actively seeking to understand how predictive models reshape operations and strategy.

Enterprises in the United States, Europe and Asia now use predictive analytics to anticipate customer churn, forecast demand across global supply chains, and model the impact of pricing, promotions and capacity decisions under multiple macroeconomic scenarios. Prescriptive analytics extends this capability by recommending specific interventions, such as dynamically adjusting production schedules in German automotive plants, reallocating marketing budgets for UK and French retailers, or optimizing staffing and bed management in Canadian and Australian healthcare systems. Public cloud platforms including Microsoft Azure, Google Cloud and Amazon Web Services have significantly reduced the technological barriers to adopting such methods, yet the decisive differentiator remains organizational competence: the capability to ask the right business questions, interpret probabilistic outputs correctly, and embed analytics into everyday workflows from the front line to the boardroom.

In an era defined by inflation cycles, energy price volatility, supply chain realignments, climate-related disruptions and geopolitical tensions, this predictive and prescriptive capability has become central to economic resilience. Monetary authorities such as the Federal Reserve in the United States and the European Central Bank rely on increasingly sophisticated models to assess inflation expectations, financial stability risks and the transmission of monetary policy, while corporations deploy scenario-based analytics to stress-test investment plans and capital structures. Decision-making that once depended primarily on executive intuition is now complemented by structured data-driven insights, yielding a more transparent, auditable and disciplined approach to strategy.

Analytics as a Driver of Product, Service and Business Model Innovation

Data analytics is not only improving existing operations; it is also acting as a powerful catalyst for new products, services and business models. Digital pioneers such as Amazon, Netflix and Spotify demonstrated early how behavioral and contextual data can power hyper-personalized experiences and continuous product refinement, but similar approaches have now been widely adopted by banks, insurers, industrial manufacturers, mobility providers, energy companies and public agencies. Senior executives and founders closely follow research from sources like Harvard Business Review to learn more about data-driven product development and experimentation, recognizing that analytics-led innovation substantially reduces the risk of misaligned investments and accelerates time to market.

In financial services, major global institutions including JPMorgan Chase, HSBC, BNP Paribas and Barclays are using analytics to design tailored lending products, dynamic credit lines, real-time risk-based pricing and personalized wealth management offerings, drawing on transaction histories, behavioral signals, alternative data and real-time risk scoring. In the rapidly evolving world of digital assets and decentralized finance, analytics platforms help institutional and retail investors, as well as regulators, to track crypto market behavior and systemic risk, enabling more robust product design, compliance and investor protection. Industrial leaders in Germany, Japan, South Korea and the Nordic countries are using sensor data from connected machinery to deliver outcome-based "as-a-service" models, where customers pay for uptime, performance or output rather than asset ownership, fundamentally reshaping revenue streams and customer relationships.

The underlying engine of this innovation is the feedback loop between data, experimentation and learning. High-performing organizations establish cross-functional teams that blend data scientists, domain experts, product managers, marketers and operations leaders, enabling them to interpret customer signals holistically and conduct rapid, controlled experiments across channels and markets. Academic institutions such as the MIT Sloan School of Management continue to emphasize how data-driven experimentation, when combined with strong governance, can accelerate innovation while managing strategic and operational risk. For the founder and executive community that turns to Business-Fact.com for guidance on scaling ventures and entering new markets, mastering this feedback loop is increasingly seen as a prerequisite to staying ahead of both incumbents and agile new entrants.

The Deepening Convergence of Data Analytics and Artificial Intelligence

By 2026, the boundary between data analytics and artificial intelligence has become deeply intertwined, especially with the mainstream adoption of large language models, multimodal AI and domain-specific machine learning systems. What used to be distinct initiatives-business intelligence projects on one side and experimental AI pilots on the other-have converged into integrated data and AI platforms that underpin decision-making, automation and customer engagement. Readers interested in the AI dimension regularly explore how artificial intelligence is transforming business strategy and redrawing the competitive landscape across industries.

Major technology companies including OpenAI, Google, Meta, IBM and leading players in China and South Korea have invested heavily in foundational models and AI infrastructure, making advanced capabilities available through APIs and cloud services. Consulting firms and systems integrators are building specialized AI and analytics practices to help organizations embed these technologies into core processes, from risk and compliance to supply chain optimization and personalized customer service. The World Economic Forum continues to highlight how AI and analytics together are reshaping jobs, skills and the global economy, creating new opportunities while posing challenging questions about workforce adaptation, regulation and ethics.

In day-to-day practice, analytics teams increasingly use large language models to explore complex datasets, generate hypotheses, summarize unstructured information and support scenario analysis, while AI initiatives rely on robust analytics frameworks for data quality assurance, bias detection, model monitoring and performance benchmarking. Organizations that once treated AI as a peripheral experiment now demand enterprise-grade reliability, explainability and security, integrating AI capabilities into existing data warehouses, lakehouses and governance frameworks. For Business-Fact.com, which tracks technology trends and their implications for employment, investment and regulation, this convergence is one of the defining narratives of digital transformation in the mid-2020s.

Financial Markets, Banking and Investment in a Data-Intensive Era

Few sectors illustrate the transformative power of data analytics as vividly as financial markets, banking and investment management, where information advantages and risk insights translate directly into economic performance. Global asset managers, hedge funds, proprietary trading firms and market makers in New York, London, Frankfurt, Zurich, Hong Kong and Singapore have long used quantitative models to identify pricing anomalies and manage portfolio risk, but the breadth and depth of data they now employ have expanded dramatically. Satellite imagery, mobility data, web traffic, social media sentiment, alternative credit data and supply chain intelligence are increasingly integrated into investment models, while exchanges such as the New York Stock Exchange and London Stock Exchange Group use advanced analytics to enhance market surveillance, detect manipulation and support regulatory reporting.

Retail and commercial banks across the United States, Europe, the Middle East and Asia-Pacific use analytics to refine credit scoring, detect fraud in milliseconds, optimize liquidity and capital allocation, and comply with increasingly complex regulatory regimes. Institutions such as Bank of America, Deutsche Bank, UBS and Standard Chartered are investing heavily in centralized data platforms, AI-driven risk models and real-time monitoring capabilities. For readers of Business-Fact.com who follow banking and investment, the integration of analytics into regulatory stress testing, anti-money laundering systems, climate risk modeling and digital asset oversight is particularly significant, as it shapes both financial stability and long-term asset valuation. Supervisory bodies, including the Bank for International Settlements, are publishing extensive guidance to help institutions strengthen model risk management and data governance.

In public equity and debt markets, analytics supports algorithmic trading, liquidity provision, investor relations, ESG reporting and capital raising strategies. Listed companies use investor behavior data, macroeconomic indicators and peer benchmarking to refine their communication with shareholders and optimize the timing and structure of capital market transactions, while data platforms such as Bloomberg and LSEG Data & Analytics provide powerful tools to institutional investors worldwide. Observers tracking stock market developments recognize that the ability to process information faster and more accurately than competitors can be a decisive edge, yet they also acknowledge that overreliance on opaque or poorly governed models can amplify systemic risks, underscoring the importance of expertise, transparency and regulatory oversight.

Data-Driven Marketing, Customer Experience and Brand Trust

Marketing, customer experience and brand strategy have been profoundly reshaped by data analytics, particularly in digitally mature markets such as the United States, the United Kingdom, Germany, France, the Netherlands, the Nordics, Singapore and South Korea. Every interaction-website visits, mobile app usage, search queries, social media engagement, in-store behavior and call center conversations-can be captured and analyzed to refine targeting, messaging, pricing and service design. Platforms operated by Google, Meta, TikTok, Amazon Advertising and other global players offer highly granular audience and performance data, while marketing technology ecosystems now include customer data platforms, identity resolution tools, attribution models and real-time personalization engines. Marketers and growth leaders turn to Business-Fact.com to better understand data-driven customer journeys and digital marketing strategies, recognizing that analytics competence has become a central determinant of return on marketing investment.

However, the privacy and regulatory environment in 2026 is materially different from that of even a few years ago. The General Data Protection Regulation (GDPR) in the European Union, the California Consumer Privacy Act (CCPA) and the California Privacy Rights Act in the United States, Brazil's LGPD, Canada's evolving privacy framework, and similar regulations in countries such as South Korea and Singapore have significantly constrained the use of third-party cookies and tightened consent, transparency and data minimization requirements. Large technology platforms have also implemented changes to tracking and data sharing practices, forcing brands to invest more heavily in first-party data strategies, value-driven loyalty programs and explicit permission-based engagement. Organizations that articulate a clear privacy stance and demonstrate responsible data stewardship are better positioned to earn customer trust, while those that treat data as a purely extractive asset face growing reputational and regulatory risks.

Analytics-driven personalization can substantially enhance customer satisfaction, loyalty and lifetime value when implemented thoughtfully, yet it simultaneously raises questions around fairness, manipulation and digital well-being. Institutions such as the OECD continue to analyze how data-driven marketing affects consumer autonomy, competition and market structure and encourage businesses to adopt responsible data and AI practices. For the business audience of Business-Fact.com, these dynamics highlight the imperative to balance short-term performance metrics with long-term brand equity, stakeholder trust and compliance obligations, especially in highly competitive sectors such as retail, travel, financial services and digital media.

Employment, Skills and the Analytics-Driven Future of Work

The impact of data analytics on employment is complex and nuanced, affecting job creation, skills demand, organizational design and workplace culture across regions and industries. Demand for data scientists, analytics engineers, machine learning specialists, AI product managers and data-savvy business leaders continues to outstrip supply in North America, Europe, India, China and Southeast Asia, with organizations in sectors as diverse as manufacturing, logistics, healthcare, government and professional services competing for scarce expertise. At the same time, automation of routine analytical tasks, reporting functions and parts of decision support is reshaping roles in finance, operations, customer service and middle management, prompting debates about job displacement, reskilling and the distribution of productivity gains. Analysts and policymakers increasingly turn to platforms such as Business-Fact.com to follow how data and AI are reshaping employment patterns and to understand emerging policy responses.

Forward-looking organizations are investing in broad-based data literacy and AI fluency, not only for technical specialists but also for managers and frontline employees. Corporate academies, in-house training programs and partnerships with platforms like Coursera and edX are being used to equip staff with the ability to interpret dashboards, question model outputs, collaborate with data teams and understand the ethical and regulatory implications of analytics. Reports from the International Labour Organization emphasize that skills development, social dialogue and inclusive labor policies are essential to ensuring that the economic benefits of analytics and automation are widely shared rather than concentrated in a narrow set of firms or regions.

Within organizations, analytics is also being applied to workforce planning, internal mobility, performance management and employee experience. Predictive models are used to anticipate attrition risk, identify emerging skill gaps and match employees to suitable development opportunities, while sentiment analysis and collaboration analytics help leaders understand engagement and collaboration patterns. These applications can support more personalized career development and better resource allocation, yet they also raise legitimate concerns about surveillance, bias, transparency and consent. Companies that wish to maintain trust and comply with evolving labor and privacy regulations must establish clear policies, involve employee representatives and embed ethical review into their people analytics programs.

Governance, Ethics and Trust in the Age of Pervasive Analytics

Technical excellence in data analytics is only one part of what stakeholders now demand; governance, ethics and trustworthiness have become equally critical. A series of high-profile data breaches, algorithmic discrimination cases and opaque AI deployments over the past decade has heightened public and regulatory scrutiny, leading investors, customers and civil society organizations to assess corporate data practices as a core element of risk and reputation. For the global audience of Business-Fact.com, which monitors regulatory and geopolitical trends and corporate governance developments, the way organizations manage data and analytics has become a key indicator of leadership quality and long-term resilience.

Modern data governance frameworks encompass data quality, lineage, access controls, lifecycle management, model risk management and ethical guidelines, often overseen by chief data officers and cross-functional committees that include legal, compliance, risk and business leaders. International standards and policy initiatives, including ISO data management standards, the NIST AI Risk Management Framework and the European Union's AI Act, provide reference points for organizations seeking to implement responsible AI and analytics practices. Boards are increasingly asking detailed questions about how models are validated, how bias and drift are monitored, how explainability is ensured in high-stakes decisions such as lending, hiring and healthcare, and how incident response and accountability are structured when things go wrong.

Trustworthiness also depends on transparent engagement with customers, employees, partners and regulators. Clear communication about what data is collected, why it is collected, how it is processed and what benefits it delivers is becoming a competitive differentiator, particularly as stakeholders become more sophisticated in their understanding of digital rights and AI risks. Large institutional investors and sovereign wealth funds are incorporating data governance and AI ethics into their ESG assessments, recognizing that poor practices can lead to regulatory sanctions, litigation and long-lasting reputational damage. In this environment, the ability to demonstrate robust, well-documented and independently auditable analytics processes is emerging as a source of strategic advantage and a prerequisite for sustainable growth.

Analytics as an Enabler of Sustainable and Inclusive Growth

Sustainability and inclusive growth have moved to the center of corporate and policy agendas worldwide, and data analytics is playing a pivotal role in turning high-level commitments into measurable action. Companies seeking alignment with frameworks such as the UN Sustainable Development Goals, the Task Force on Climate-related Financial Disclosures (TCFD) and the International Sustainability Standards Board (ISSB) rely on analytics to track emissions, resource consumption, supply chain impacts and social indicators, enabling them to set science-based targets, model transition risks and opportunities, and report credibly to investors and regulators. Business leaders who wish to learn more about sustainable business practices recognize that high-quality, well-governed data is essential for credible sustainability strategies.

In energy, transport and heavy industry, analytics supports the optimization of energy consumption, predictive maintenance of critical infrastructure and the integration of renewable sources into power grids, with utilities and grid operators across Europe, North America and Asia deploying advanced forecasting and control systems. In agriculture and food systems, precision farming techniques use sensor, drone and satellite data to reduce water use, optimize fertilizer application and improve yields, contributing to both environmental resilience and food security. Organizations such as the World Resources Institute provide tools and frameworks that help businesses measure and manage environmental performance, illustrating how data can bridge corporate strategy with planetary boundaries and regulatory expectations.

Inclusive growth also benefits from data-driven approaches. Governments, multilateral organizations and NGOs use analytics to identify underserved communities, target social programs, evaluate the impact of interventions and design evidence-based policies. Financial institutions and fintech innovators are using alternative data and advanced scoring models to expand credit access for small businesses and individuals in emerging markets across Africa, South Asia and Latin America, while impact investors rely on data to track social and environmental outcomes alongside financial returns. At the same time, concerns about digital divides, data colonialism and unequal access to analytics capabilities remind leaders that responsible data strategies must consider power imbalances and local context. For Business-Fact.com, which covers macroeconomic and regional developments, the interplay between analytics, sustainability and inclusion is a defining theme in the evolving architecture of globalization.

Building High-Impact Analytics Capabilities: Lessons for Leaders and Founders

For established corporations and emerging ventures alike, building robust analytics capabilities in 2026 requires a deliberate combination of strategic clarity, modern infrastructure, talent development and cultural change. Leaders must articulate a clear vision of how data will support competitive advantage-whether through operational excellence, product and service innovation, customer intimacy, risk management or sustainability-and align investments, organizational structures and metrics accordingly. Infrastructure decisions around cloud providers, data warehouses, lakehouses, integration tools and security architectures must be guided by scalability, interoperability, compliance and vendor risk considerations rather than short-term cost alone. Executives seeking to explore how innovation and analytics intersect often turn to case studies and frameworks from institutions such as Harvard Business School and INSEAD, which analyze both successful and failed digital transformations.

Talent strategy is a central determinant of success. Organizations that rely exclusively on a small, isolated group of technical experts often struggle to translate analytics into business impact, whereas those that cultivate cross-functional teams and invest in data literacy across the enterprise are better positioned to embed insights into daily decisions. Incentive structures, governance mechanisms and performance metrics need to reward evidence-based decision-making, experimentation and learning, while ensuring appropriate risk controls, especially in regulated industries such as banking, healthcare, energy and transportation. Partnerships with universities, startups and technology providers can accelerate capability building, but they also require careful management of intellectual property, data sharing, cybersecurity and cultural integration.

Founders and early-stage companies, many of whom form a core part of the Business-Fact.com audience, enjoy the advantage of designing data-centric business models from the outset. They can architect products, processes and customer experiences around analytics and automation, building scalable data foundations before legacy complexity sets in. Nevertheless, resource constraints require rigorous prioritization of use cases that deliver clear and rapid value, such as customer acquisition efficiency, pricing optimization, operational visibility or investor reporting. As these ventures scale and attract institutional capital, questions of governance, auditability, ethics and regulatory compliance become more prominent, requiring a shift from informal practices to structured frameworks that can withstand due diligence by investors, regulators and strategic partners.

The Road Ahead for Data-Driven Innovation

Looking beyond 2026, the trajectory of data analytics suggests both vast opportunity and growing complexity. Advances in areas such as quantum computing, federated learning, privacy-enhancing technologies, edge analytics and domain-specific AI agents promise to unlock new capabilities and business models, while geopolitical tensions, cyber threats, data localization mandates and regulatory fragmentation may complicate cross-border data flows and collaboration. Organizations that aspire to remain at the forefront of innovation will need to monitor these developments closely, engage with policymakers and industry bodies, and invest in adaptive strategies capable of responding to shifting technological, regulatory and competitive landscapes.

For the global business community that relies on Business-Fact.com for news, analysis and strategic insight across sectors and regions, one conclusion is increasingly evident: data analytics is not a peripheral or optional capability. It is a foundational competence that underpins competitive advantage, resilience and responsible leadership in an ever more digital and interconnected world. The organizations that combine deep analytical expertise with robust governance, ethical principles and a commitment to sustainable, inclusive growth will be best positioned to navigate uncertainty, capture emerging opportunities and earn the enduring trust of stakeholders across North America, Europe, Asia-Pacific, Africa and South America.

Ultimately, the story of data analytics is not simply about algorithms, cloud platforms or dashboards; it is about how businesses choose to wield information in the service of innovation, value creation and societal progress. As 2026 unfolds and new technologies, regulations and market dynamics emerge, the central challenge for executives, founders, investors and policymakers will be to harness the power of data with the wisdom, responsibility and long-term perspective that this pivotal moment in economic and technological history demands.