Long-Term Growth Investment Strategies for Business Owners in 2026

In 2026, business owners operate in an environment defined by structural uncertainty, rapid technological change, and shifting geopolitical realities, yet the fundamental imperative remains unchanged: design strategies that deliver sustainable, long-term growth while managing near-term volatility. The investment landscape has evolved significantly since the early 2020s, shaped by accelerated digitalization, climate commitments, demographic transitions, and new regulatory frameworks across major economies. While speculative gains and short-term market swings still dominate headlines, enduring business success increasingly depends on disciplined, forward-looking investment decisions that build resilience, adaptability, and innovation capacity over many years rather than a few quarters.

This article examines how business leaders can craft long-term growth investment strategies that integrate traditional financial discipline with a modern understanding of technology, sustainability, and global market dynamics. Drawing on patterns observed across international markets and the experience of leading organizations, it outlines a practical framework that aligns capital allocation with structural trends, robust risk management, and the trust-focused expectations of stakeholders in 2026. As a global analysis platform, business-fact.com is positioned at the intersection of these developments, and the perspectives presented here reflect the themes most relevant to its audience in business, markets, employment, technology, and sustainable growth.

Building the Foundation of Long-Term Growth

A long-term growth strategy begins with clarity of purpose and alignment with markets that are likely to expand over the next decade. Business owners must increasingly think in terms of structural drivers rather than cyclical fluctuations, recognizing that sectors such as renewable energy, advanced manufacturing, artificial intelligence, digital infrastructure, and sustainable finance are underpinned by powerful policy, demographic, and technological forces that transcend short-term downturns. This requires rigorous strategic planning that connects a company's core capabilities with these long-term growth vectors, supported by data, scenario analysis, and continuous market intelligence.

Understanding how demand is evolving is central to this process. Consumer expectations in the United States, Europe, and across Asia have shifted decisively toward digital convenience, transparency, and environmental responsibility, creating premium opportunities for businesses that integrate sustainability into their value propositions rather than treating it as a compliance exercise. Readers can explore how these dynamics are reshaping business models in more depth through the analysis at business-fact.com/business, where long-term competitiveness is increasingly linked to the ability to combine profitability with responsible practices and differentiated customer experience.

Strategic Diversification Across Geographies and Sectors

The events of the last decade have reinforced that concentration risk-whether in a single country, currency, sector, or technology-can rapidly undermine otherwise sound business strategies. In 2026, effective diversification remains one of the most reliable tools for protecting long-term growth. Business owners are rethinking geographic exposure, balancing the innovation strength and legal predictability of markets such as the United States, Germany, and Japan with the demographic momentum and digital adoption of emerging economies in India, Southeast Asia, and parts of Africa and South America.

Diversification is no longer limited to spreading investments across industries; it extends to supply chains, digital platforms, financing sources, and talent pools. The experience of companies that relied heavily on single-source manufacturing or narrowly defined export markets has made it clear that resilience requires multiple routes to market and flexible operations. The global perspective available at business-fact.com/global illustrates how organizations that proactively diversified before recent disruptions have recovered faster and captured share from more concentrated competitors.

Innovation and Technology as Core Investment Pillars

By 2026, digital transformation is not a project but a continuous discipline, and investment in innovation has become a central pillar of long-term strategy rather than a discretionary line item. Artificial intelligence, in particular, has moved from pilot programs into the operational core of businesses across sectors. Companies in retail, logistics, healthcare, banking, and manufacturing now rely on AI-driven decision support, automation, and personalization to maintain competitiveness and margin. Those that underinvest in these capabilities risk being structurally disadvantaged on cost, speed, and customer relevance.

The role of AI extends beyond process optimization into new product creation, predictive risk management, and intelligent marketing. Business leaders who wish to understand how AI is reshaping competitive dynamics can learn more about artificial intelligence in business, where the focus is on practical, revenue-generating applications rather than purely experimental deployments. Parallel to AI, investment in cloud infrastructure, cybersecurity, data governance, and interoperability has become essential, as regulators in regions such as the European Union and United Kingdom tighten expectations around privacy, algorithmic transparency, and critical infrastructure resilience.

Innovation investment is not limited to technology platforms; it also encompasses research and development, intellectual property creation, and partnerships with universities, startups, and research labs. Global leaders such as Microsoft, Alphabet, Siemens, and Samsung demonstrate how persistent, high-level R&D spending translates into defensible competitive advantages, from proprietary chips and software ecosystems to specialized industrial solutions. Smaller firms can emulate this by focusing their innovation budgets on clearly defined niches where they can own specific technologies or processes rather than attempting to compete broadly. Insightful perspectives on how technology and innovation intersect with corporate strategy can be found at business-fact.com/innovation and business-fact.com/technology, which highlight how targeted innovation programs compound value over time.

Navigating Financial Markets and Investment Vehicles

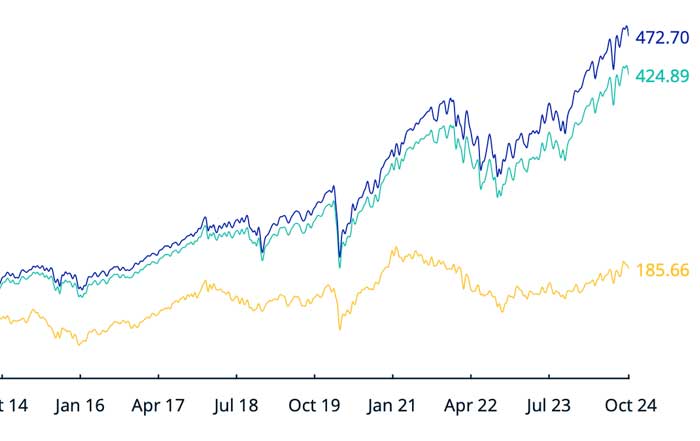

Financial markets in 2026 present both opportunity and complexity. Equity markets in North America, Europe, and Asia remain critical channels for long-term capital formation and wealth creation, yet valuations, sector rotation, and interest rate cycles require disciplined analysis. Business owners who allocate capital to listed securities increasingly focus on companies with strong balance sheets, recurring revenue models, robust governance, and clear innovation roadmaps, rather than purely momentum-driven names. Independent resources such as the New York Stock Exchange and London Stock Exchange provide market data and listing information that help investors evaluate corporate fundamentals and long-term strategies.

Within corporate strategy, equity markets play a dual role: as a source of funding for expansion and as a benchmark for valuation and performance. Business owners considering listings or secondary offerings must weigh the benefits of liquidity and visibility against the obligations of disclosure and short-term earnings scrutiny. The coverage at business-fact.com/stock-markets underscores that companies which communicate a coherent long-term narrative, backed by consistent investment in growth drivers, tend to be rewarded over time despite intermittent volatility.

Alongside public markets, private equity, growth capital, and venture capital have continued to expand, particularly in sectors such as climate technology, digital health, fintech, and enterprise software. Institutional investors and family offices across Canada, Australia, Singapore, and the Nordic countries are allocating more capital to private strategies in search of long-duration returns and exposure to innovation not yet represented in public indices. Business owners can participate either as recipients of this capital or as limited partners and co-investors, gaining both financial returns and strategic insight. The Institutional Limited Partners Association and Invest Europe provide useful frameworks for understanding best practices in private market governance and alignment.

Sustainable and Responsible Investment as a Strategic Imperative

Sustainability has moved decisively from optional to foundational in long-term investment strategy. Environmental, Social, and Governance (ESG) integration is now embedded in regulatory frameworks in the European Union, the United Kingdom, and increasingly in the United States, Canada, and Asia-Pacific, with disclosure standards and taxonomies guiding how capital is allocated. Asset managers and banks globally are aligning lending and investment decisions with climate and social objectives, making sustainability performance a determinant of access to capital and cost of funding.

For business owners, this means that investments in energy efficiency, low-carbon technologies, circular economy models, and responsible supply chains are not merely reputational choices but financially rational decisions that influence credit ratings, investor appetite, and long-term valuation. Organizations such as the Task Force on Climate-related Financial Disclosures and the International Sustainability Standards Board provide frameworks that help companies report and manage climate and sustainability risks in a structured way. Readers seeking to align their strategies with these expectations can learn more about sustainable business practices, where the emphasis is on linking ESG performance to tangible business outcomes.

Green finance has also expanded significantly. Green bonds, sustainability-linked loans, and transition finance instruments are being deployed by corporations, municipalities, and sovereigns worldwide. The International Energy Agency (IEA), accessible via iea.org, continues to publish scenarios that highlight the scale of investment required to achieve net-zero pathways, particularly in renewable energy, grid modernization, and electrification. Companies that position themselves as credible actors in these value chains-through direct investments, joint ventures, or technology development-are better placed to capture long-term growth as climate policy tightens and consumer preferences evolve.

Human Capital, Employment, and Leadership Investment

No long-term investment strategy is complete without a deliberate focus on people. In 2026, talent markets are shaped by hybrid work models, demographic aging in many advanced economies, and intense competition for skills in areas such as data science, cybersecurity, advanced engineering, and green technologies. Business owners are recognizing that investment in workforce development-through continuous learning, internal mobility programs, and partnerships with educational institutions-is a strategic necessity rather than a discretionary benefit.

Global employment trends, including automation, remote work, and the rise of the gig economy, are analyzed at business-fact.com/employment, where the emphasis is on aligning workforce strategies with long-term business models. Companies that systematically reskill employees for new technologies and processes are better positioned to implement innovation without disruption and to retain institutional knowledge, which is increasingly recognized as a critical intangible asset.

Leadership development and succession planning are equally important. Many founder-led firms in regions from Silicon Valley to Berlin, Singapore, and Bangalore have discovered that the absence of clear governance and transition structures can erode value precisely at the point when growth accelerates. Effective boards, independent oversight, and transparent succession frameworks help maintain strategic continuity and investor confidence. Case studies and insights at business-fact.com/founders illustrate how visionary founders who embrace structured governance and professional management teams tend to build more durable enterprises than those who centralize decision-making indefinitely.

Global and Regional Investment Trends in 2026

The global investment map in 2026 reflects differentiated strengths and risks across regions. The United States remains the primary hub for technology, life sciences, and venture capital, supported by deep capital markets, strong intellectual property protection, and a robust startup ecosystem. Organizations such as the U.S. Small Business Administration and U.S. Chamber of Commerce provide guidance on financing, regulation, and expansion that are relevant to both domestic and international firms seeking exposure to the American market.

In Europe, policy remains a powerful driver of investment patterns. The European Green Deal, the Corporate Sustainability Reporting Directive (CSRD), and initiatives under the European Commission are channeling capital toward energy transition, sustainable mobility, and digital sovereignty. Countries such as Germany, France, Netherlands, Sweden, and Denmark are consolidating their roles as leaders in green technologies, from offshore wind and hydrogen to energy-efficient buildings and circular manufacturing. This policy-driven environment creates both opportunities and obligations for investors and operators, particularly those that can combine technological expertise with compliance capabilities.

Across Asia, growth is defined by digital acceleration and a diverse mix of advanced and emerging markets. China continues to invest heavily in semiconductors, electric vehicles, renewable energy, and digital platforms, even as regulatory recalibration in sectors such as tech platforms and real estate has altered risk perceptions. South Korea and Japan remain leaders in advanced manufacturing, robotics, and electronics, while Singapore has cemented its status as a regional financial and technology hub, especially in digital banking and fintech regulation. Emerging economies like India, Indonesia, Vietnam, and Philippines offer compelling long-term demand stories, driven by young populations, rising incomes, and rapid technology adoption. The World Bank and International Monetary Fund provide macroeconomic and structural data that help business owners evaluate these markets from a long-term perspective, complementing the regional analysis available at business-fact.com/economy.

Crypto, Blockchain, and the Institutionalization of Digital Assets

Digital assets have evolved from a speculative niche into an increasingly institutionalized component of the global financial system. By 2026, major jurisdictions including the European Union, United States, United Kingdom, and Singapore have implemented or advanced comprehensive regulatory frameworks for crypto assets, stablecoins, and digital asset service providers. This has reduced some of the legal uncertainty that previously constrained corporate adoption, even as volatility and technology risks remain.

For business owners, the role of cryptocurrencies and tokenized assets in long-term strategy is now more nuanced. Some companies use blockchain-based systems to streamline cross-border payments, enhance supply chain transparency, and manage digital identity, while others explore tokenization of real estate, infrastructure, or intellectual property to broaden investor access and unlock liquidity. Organizations such as the Bank for International Settlements and Financial Stability Board track the evolution of central bank digital currencies (CBDCs) and regulatory standards, which are shaping how digital money integrates with traditional banking. Readers interested in how these developments intersect with corporate finance and innovation can explore business-fact.com/crypto, where the emphasis is on practical business applications rather than speculative trading.

Marketing, Brand, and Data as Long-Term Assets

In 2026, marketing has fully transitioned into a data-driven, technology-enabled discipline that directly influences enterprise value. Investments in brand, analytics, and customer experience are increasingly evaluated alongside capital expenditures, as companies recognize that strong brands and deep customer insight generate pricing power, loyalty, and resilience in downturns. Advanced analytics, powered by AI and privacy-compliant data collection, allow firms to tailor offerings to specific segments across regions such as North America, Europe, and Asia-Pacific, while omnichannel strategies integrate physical and digital touchpoints.

Effective marketing investment requires robust measurement frameworks, including customer lifetime value, retention rates, and brand equity indicators, supported by experimentation and test-and-learn cultures. Regulatory developments, such as data protection laws in the European Union and evolving privacy standards in the United States and other jurisdictions, mean that responsible data governance is now integral to marketing strategy. Business leaders can explore how to align marketing investments with long-term growth objectives at business-fact.com/marketing, where the focus is on using technology and creativity to build durable customer relationships.

Financial Resilience, Capital Structure, and Risk Management

Long-term growth is only sustainable if supported by a resilient financial foundation. In 2026, higher-for-longer interest rate scenarios, ongoing inflation risks in certain regions, and geopolitical tensions affecting trade and energy markets underscore the importance of prudent balance sheet management. Business owners are reevaluating leverage levels, refinancing risk, and currency exposure, aiming to maintain flexibility to invest when opportunities arise while preserving buffers against downturns.

Optimal capital structures vary by sector and company maturity, but common principles include diversified funding sources, staggered debt maturities, adequate liquidity reserves, and clear policies for reinvestment versus distributions. The Bank for International Settlements and national central banks such as the Federal Reserve and European Central Bank provide guidance and analysis on monetary conditions that influence borrowing costs and asset valuations. For a broader investment perspective that connects macroeconomic trends with corporate strategy, readers can turn to business-fact.com/investment and business-fact.com/banking, which explore how financial system developments affect business decision-making.

Risk management in this environment extends beyond finance to encompass cyber risk, regulatory compliance, supply chain resilience, and reputational risk. Companies are investing in robust internal controls, enterprise risk management frameworks, and insurance solutions, while also using data analytics and scenario planning to anticipate potential disruptions. Those that integrate risk management into strategic planning, rather than treating it as a separate function, are better able to pursue growth opportunities confidently.

The Central Role of Trust, Governance, and Transparency

Underlying all successful long-term investment strategies is trust. Stakeholders-including investors, employees, customers, regulators, and communities-are increasingly demanding transparency around strategy, performance, and impact. Strong corporate governance, clear reporting, and ethical conduct are now recognized as value drivers rather than mere compliance obligations. Organizations such as the OECD and World Economic Forum provide principles and case studies on governance and stakeholder capitalism that help companies benchmark their practices against global standards.

For founder-led and privately held businesses, governance maturity can be a decisive factor in attracting institutional capital, entering new markets, and managing leadership transitions. As documented in the analysis at business-fact.com/news, investors increasingly differentiate between companies that can demonstrate robust oversight, clear accountability, and credible long-term plans and those that cannot. Transparent communication about strategy, risks, and progress builds confidence and allows stakeholders to support long-term initiatives even when short-term results fluctuate.

Conclusion: Designing Strategies Today for Durable Growth Tomorrow

In 2026, business owners face a complex mix of challenges and opportunities, but the principles of long-term growth investment are becoming clearer. Sustainable success requires aligning capital allocation with structural trends in technology, demographics, and sustainability; diversifying across geographies, sectors, and funding sources; and embedding innovation, human capital development, and risk management at the core of strategy. It also demands a commitment to governance, transparency, and stakeholder trust that reflects the expectations of global markets and societies.

For the global audience of business-fact.com, from entrepreneurs and founders to corporate executives and investors across North America, Europe, Asia, Africa, and South America, the message is consistent: long-term growth is not the product of a single bold bet but of disciplined, informed, and adaptive decision-making over many years. By leveraging resources such as business-fact.com, staying attuned to developments in technology, markets, and regulation, and maintaining a clear strategic vision, business leaders can design investment strategies today that build enduring value well into the next decade.