How American Innovation Is Shaping the Global Economy in 2026

As the world economy adjusts to an environment defined by persistent geopolitical tension, shifting monetary policy, and accelerating technological disruption, the United States continues to operate as the primary engine of commercial innovation. In 2026, the country's ecosystem of high-growth startups, research institutions, and multinational enterprises is not only creating new markets but also redefining the rules of competition across sectors as diverse as artificial intelligence, clean energy, biotechnology, financial technology, and advanced manufacturing. For the global audience of Business-Fact.com, understanding the structure, direction, and implications of this innovation system has become a strategic necessity rather than a matter of curiosity, because the decisions made in American boardrooms, laboratories, and venture capital firms now reverberate through stock markets, employment patterns, and investment flows from North America and Europe to Asia, Africa, and Latin America.

This innovation landscape is characterized by an intricate interplay between private capital, public policy, talent migration, and consumer adoption, which together create a flywheel that is difficult for other regions to replicate at scale. While countries such as Germany, Japan, South Korea, Singapore, and the United Kingdom have built formidable technology clusters, the density of entrepreneurial activity in the United States-reinforced by deep capital markets and a culture of risk-taking-continues to give American firms an outsized influence on the global trajectory of business and technology. Readers seeking ongoing coverage of these dynamics can refer to the core business overviews at Business-Fact Business Insights, which regularly connect U.S. developments to global implications.

Artificial Intelligence as the Strategic Core of U.S. Competitiveness

By 2026, artificial intelligence has moved from experimental pilot projects to mission-critical infrastructure for corporations, governments, and financial institutions. American firms such as OpenAI, Anthropic, Google DeepMind, and Cohere have established themselves as central providers of foundational models that underpin a growing universe of specialized applications, from clinical decision support and industrial automation to fraud detection and real-time translation. The United States benefits from a unique concentration of AI research talent originating from leading universities and research centers, many of which are documented through open publications and benchmarks accessible via organizations like MIT CSAIL and the Allen Institute for AI.

The commercialization of AI has given rise to thousands of startups building domain-specific tools that integrate deeply into existing workflows rather than sitting at the periphery as optional add-ons. In healthcare, companies such as Tempus and Insitro apply machine learning to genomic data and clinical records to accelerate drug discovery and personalize treatment. In logistics, firms building on the work of Flexport and similar innovators are optimizing multimodal shipping routes, inventory planning, and customs documentation, which in turn affects trade flows between the United States, Europe, and Asia. As AI systems become more capable in reasoning, planning, and multimodal understanding, their impact on productivity is increasingly visible in macroeconomic data tracked by entities such as the U.S. Bureau of Labor Statistics.

For executives and investors, the strategic question has shifted from whether to adopt AI to how rapidly and comprehensively it can be embedded across operations, products, and decision-making processes. The coverage at Business-Fact Artificial Intelligence examines the competitive advantages and governance challenges arising from this adoption, including issues around regulation, intellectual property, and workforce reskilling, which are becoming central to board-level discussions worldwide.

Clean Energy, Climate Tech, and the Economics of Decarbonization

Climate and energy security have moved from long-term policy concerns to immediate economic priorities, particularly for regions vulnerable to energy price volatility and extreme weather events. In this context, the United States has emerged as a focal point for climate technology innovation, catalyzed in part by federal initiatives such as the Inflation Reduction Act and state-level programs that provide tax incentives, grants, and loan guarantees for clean energy projects. These frameworks have attracted both domestic and foreign capital into renewable generation, grid-scale storage, carbon capture, and industrial decarbonization, with data and analysis frequently highlighted by organizations such as the International Energy Agency.

Startups including Form Energy are pioneering long-duration energy storage solutions that address the intermittency challenges of wind and solar, while companies like CarbonCure and Climeworks are developing technologies to embed or remove COâ in industrial processes and infrastructure. In transportation, Tesla and Rivian remain highly visible leaders, but a new wave of companies is focusing on electric aviation, hydrogen propulsion, and battery recycling, with implications for supply chains that stretch from lithium mines in South America to manufacturing hubs in Asia and Europe. These developments are closely monitored by institutions such as the U.S. Department of Energy, which provides visibility into federal support mechanisms and technology roadmaps.

For corporate strategists and institutional investors, decarbonization is now evaluated not only as a compliance requirement but as a source of competitive differentiation, operational resilience, and long-term value creation. The sustainable business coverage at Business-Fact Sustainable Insights explores how firms across sectors can integrate climate technologies into their operating models, capital allocation decisions, and risk management frameworks, ensuring that environmental commitments translate into measurable financial outcomes.

Fintech, Crypto, and the Reconfiguration of Financial Infrastructure

The transformation of financial services remains one of the most visible expressions of American innovation. Over the past decade, fintech startups have systematically unbundled traditional banking services, offering digital-first alternatives in payments, lending, wealth management, and insurance. Neobanks and embedded finance platforms have particularly reshaped the customer experience, providing seamless, mobile-centric interfaces that appeal to younger demographics and underbanked segments in the United States, Europe, and emerging markets. Regulatory agencies such as the U.S. Securities and Exchange Commission and the Consumer Financial Protection Bureau have responded by refining oversight mechanisms, which in turn influence how quickly new products can scale.

Parallel to fintech, the crypto and blockchain ecosystem has evolved from speculative experimentation to more regulated, infrastructure-oriented applications. Companies like Coinbase and Circle, issuer of USDC, continue to play central roles in digital asset markets, while a growing number of startups focus on tokenization of real-world assets, blockchain-based settlement systems, and decentralized finance protocols that aim to reduce friction in cross-border payments and capital markets. Large financial institutions in the United States, the United Kingdom, Singapore, and Switzerland are increasingly piloting blockchain-based solutions, as highlighted in research by the Bank for International Settlements.

The intersection of traditional finance and crypto now presents both opportunities and regulatory complexity for global investors. The banking and payments coverage at Business-Fact Banking and the digital asset analysis at Business-Fact Crypto provide structured perspectives on how these technologies are reconfiguring financial infrastructure, influencing monetary policy debates, and altering risk profiles across portfolios.

Biotechnology, Health Innovation, and the Economics of Longevity

Biotechnology continues to be one of the United States' most potent sources of competitive advantage, driven by a combination of world-class research universities, robust capital markets, and strong intellectual property protections. Companies such as Editas Medicine, CRISPR Therapeutics, and Intellia Therapeutics have advanced CRISPR-based gene editing from concept to clinical trials, opening pathways to treat genetic disorders that were previously considered intractable. Meanwhile, the longevity sector has attracted substantial investment, with firms like Altos Labs and Calico Labs exploring cellular reprogramming and other approaches to extend healthy lifespans. These efforts are closely followed by institutions such as the National Institutes of Health, which fund foundational research and provide guidance on ethical and regulatory considerations.

Digital health has also matured significantly since the pandemic era, with telemedicine, remote monitoring, and AI-driven diagnostics becoming embedded in mainstream healthcare delivery. Companies such as Ro, Hims & Hers, and 23andMe have demonstrated the commercial viability of direct-to-consumer health platforms, while hospital systems across the United States, Canada, and Europe integrate clinical decision support tools that leverage large datasets and predictive analytics. This convergence of biotechnology, data science, and consumer-centric design is reshaping not only patient outcomes but also the cost structures and reimbursement models of healthcare systems worldwide, as analyzed by organizations like the World Health Organization.

For business leaders, the implications extend far beyond the life sciences sector. Health innovation influences workforce productivity, insurance markets, and public policy, making it a core component of long-term economic planning. Readers can track how these developments intersect with broader global trends through Business-Fact Global Analysis, which connects breakthroughs in biotechnology to shifts in employment, regulation, and capital allocation.

Venture Capital, Capital Markets, and the Discipline of Growth

The American innovation engine rests heavily on the depth and sophistication of its capital markets. Venture capital firms such as Sequoia Capital, Andreessen Horowitz, Kleiner Perkins, and Founders Fund continue to deploy significant capital into early- and growth-stage companies; however, the environment in 2026 is notably more selective than the liquidity-fueled period of the early 2020s. Higher interest rates, a more cautious IPO market, and heightened scrutiny from limited partners have pushed investors to prioritize sustainable unit economics, clear paths to profitability, and defensible moats over pure growth narratives. This recalibration is documented in analyses by outlets like the Financial Times and consulting firms such as McKinsey & Company.

For founders, this shift has changed the calculus of scaling. Rather than pursuing aggressive expansion at all costs, many startups now focus on disciplined customer acquisition, strategic partnerships, and measured internationalization, often targeting markets in Europe, Asia-Pacific, and Latin America where regulatory environments and competitive landscapes vary significantly. The investment-focused coverage at Business-Fact Investment examines how this new discipline affects portfolio construction, sector rotation, and exit strategies for both institutional and individual investors.

Public markets remain an essential outlet for mature innovation-driven firms. The NASDAQ and New York Stock Exchange continue to attract listings from technology, biotech, and clean energy companies, though valuations now more closely reflect fundamentals and cash-flow visibility. SPAC activity has normalized after earlier excesses, and direct listings remain an option for well-known brands with strong balance sheets. The evolving relationship between private and public capital is explored in depth at Business-Fact Stock Markets, which connects innovation themes to broader equity market performance.

Advanced Manufacturing, Robotics, and Supply Chain Reconfiguration

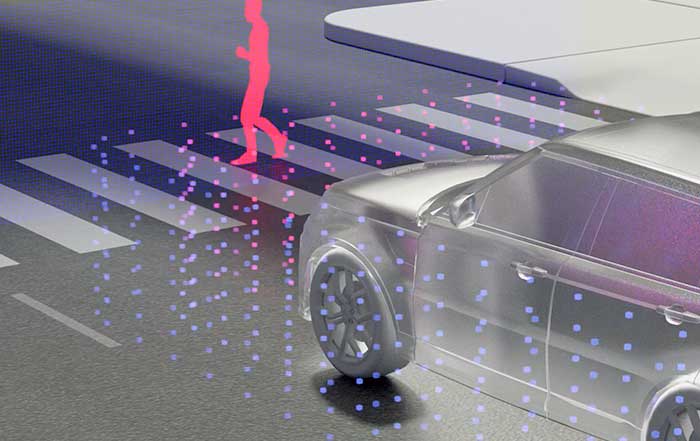

The integration of advanced manufacturing and robotics into the American industrial base is reshaping both domestic employment and global supply chains. Technologies such as additive manufacturing, collaborative robots, digital twins, and AI-driven quality control have allowed U.S. manufacturers to increase productivity while reducing dependency on low-cost labor abroad. Companies like Desktop Metal, Formlabs, and Markforged are expanding the range of materials and applications for industrial 3D printing, enabling on-demand production and rapid prototyping for sectors including aerospace, automotive, healthcare, and consumer electronics.

Robotics firms such as Boston Dynamics, Veo Robotics, and numerous warehouse automation startups are redefining how goods are produced, stored, and moved. These technologies facilitate reshoring and nearshoring strategies that have become more attractive in the wake of geopolitical tensions, trade disputes, and pandemic-related disruptions, trends closely tracked by organizations like the World Trade Organization. As companies in the United States, Mexico, and Canada reconfigure supply chains to prioritize resilience and regional integration, the macroeconomic consequences are visible in trade balances, employment statistics, and investment flows.

The economic analysis at Business-Fact Economy situates these industrial transformations within the broader context of GDP growth, inflation dynamics, and productivity trends, helping decision-makers understand how manufacturing innovation interacts with monetary policy, labor markets, and global competitiveness.

Defense, Aerospace, and the Commercial Space Economy

Defense and aerospace remain strategically significant pillars of American innovation, supported by substantial federal procurement and a dense network of contractors, startups, and research institutions. Large players such as Lockheed Martin, Northrop Grumman, and Raytheon Technologies continue to dominate major defense programs, but a new generation of startups is emerging in areas such as autonomous systems, cybersecurity, and small-satellite constellations. These firms often collaborate with agencies like the Defense Advanced Research Projects Agency and the U.S. Space Force, accelerating the transfer of cutting-edge research into deployable systems.

The commercial space sector has entered a new phase of maturity. SpaceX remains the most visible actor with its reusable launch vehicles and Starlink satellite network, but companies like Blue Origin, Rocket Lab USA, and Relativity Space are expanding the range of launch options and orbital services. The proliferation of small satellites has unlocked new business models in Earth observation, climate monitoring, global communications, and in-orbit servicing, with regulatory and partnership frameworks often coordinated through agencies such as NASA. Analysts project that the global space economy could exceed one trillion dollars in the coming decades, with American firms capturing a substantial share of this value.

For investors and corporate strategists, the space and defense sectors offer exposure to long-duration, technology-intensive projects that can serve as hedges against macroeconomic volatility. The innovation-focused coverage at Business-Fact Innovation regularly highlights how developments in aerospace and defense spill over into civilian applications, from advanced materials and navigation systems to telecommunications and climate analytics.

Marketing, Media, and the Data-Driven Customer Relationship

Innovation in the United States extends deeply into marketing, media, and the broader attention economy. As digital platforms have become the primary interface between brands and consumers across North America, Europe, and Asia, American companies and startups have led the development of tools for audience segmentation, content automation, and performance analytics. Platforms such as Google, Meta, TikTok, YouTube, and X (formerly Twitter) remain central distribution channels, but the underlying competitive advantage increasingly lies in the ability to orchestrate data and creative assets across multiple touchpoints.

Artificial intelligence plays an expanding role in this ecosystem, enabling hyper-personalized campaigns, generative content production, and real-time optimization based on behavioral signals. Companies like Cameo, Patreon, and numerous software-as-a-service providers have demonstrated how creators and brands can monetize direct relationships with audiences, bypassing traditional intermediaries. Regulatory developments around privacy and data usage, particularly in the European Union, are forcing marketers to rethink data strategies and consent mechanisms, with guidance and enforcement often led by bodies such as the European Data Protection Board.

Executives responsible for growth and brand strategy face the challenge of integrating these tools while maintaining trust, authenticity, and regulatory compliance. The marketing-focused coverage at Business-Fact Marketing provides analysis on how data-driven techniques, AI, and platform dynamics are reshaping customer acquisition, retention, and lifetime value across industries.

Employment, Skills, and the Future of Work

Innovation inevitably reshapes labor markets, and the United States provides an early view of how automation, AI, and remote work are transforming employment structures globally. High-growth sectors such as software, biotech, clean energy, and advanced manufacturing are generating demand for specialized skills, often commanding premium wages and flexible working arrangements. At the same time, routine-intensive roles in manufacturing, logistics, and some service sectors face displacement pressures as automation technologies become more capable and cost-effective. These shifts are documented in research by organizations such as the OECD and the World Economic Forum.

The rise of hybrid and fully remote work models has broadened talent pools, enabling companies to recruit across states and countries while compelling cities to rethink their economic development strategies. Platforms like Upwork, Fiverr, and enterprise collaboration tools have normalized project-based and freelance work, creating new opportunities but also raising questions about job security, benefits, and worker protections. In response, governments and educational institutions in the United States, Canada, Australia, and Europe are expanding reskilling initiatives in areas such as data science, cybersecurity, and advanced manufacturing, often in partnership with private-sector employers.

The employment-focused coverage at Business-Fact Employment analyzes these trends from both employer and worker perspectives, examining how companies can design talent strategies that balance productivity, innovation, and social responsibility in an increasingly dynamic labor market.

Founders, Ecosystems, and the Geography of Innovation

At the center of America's innovation story are its founders and entrepreneurial ecosystems. While Silicon Valley remains a powerful symbol, the geography of innovation has diversified significantly. Cities such as Austin, Miami, Denver, Atlanta, Seattle, and Boston have developed robust startup communities, each with distinct sector strengths, cost structures, and cultural attributes. This dispersion is supported by remote work, digital collaboration tools, and the willingness of venture capital firms to invest outside traditional hubs, trends tracked by organizations like the Kauffman Foundation.

Founders in 2026 operate in a more complex environment than their predecessors. They are expected to navigate regulatory scrutiny around data, competition, and labor; incorporate environmental, social, and governance considerations into their operating models; and manage global supply chains and distributed teams from an early stage. High-profile leaders such as Elon Musk, Sam Altman, and Whitney Wolfe Herd illustrate the diversity of founder archetypes, from deep-technology visionaries to consumer-platform builders, each shaping public perceptions of entrepreneurship in different ways.

The founder-focused coverage at Business-Fact Founders provides profiles, case studies, and strategic analysis that help readers understand how entrepreneurial decisions at the company level aggregate into broader patterns of innovation, competition, and value creation across the global economy.

Global Reach and Strategic Implications for 2026 and Beyond

The influence of American innovation now permeates virtually every major economy. AI platforms developed in the United States power customer service systems in Germany, predictive maintenance in Japan, and language tools in Brazil. Clean energy technologies originating from U.S. startups support decarbonization projects in India, South Africa, and Chile. Fintech models tested in American markets are adapted to local regulatory and cultural contexts across Southeast Asia, Africa, and Latin America, often in partnership with regional banks and telecom operators. International bodies such as the International Monetary Fund and the World Bank increasingly factor these technology-driven shifts into their assessments of growth prospects, financial stability, and development strategies.

For business leaders, investors, and policymakers worldwide, the central challenge is to engage with this American-led innovation wave in a way that aligns with local priorities, regulatory frameworks, and societal values. This requires not only monitoring technological trends but also understanding the underlying economic incentives, governance structures, and cultural norms that shape how innovation is developed and deployed. Business-Fact.com is positioned as a dedicated resource for this analysis, integrating coverage across technology, news, global markets, and core business themes.

As 2026 progresses, the pace of change shows no sign of slowing. The convergence of AI, biotechnology, clean energy, advanced manufacturing, and digital platforms is not merely producing new products and services; it is redefining how value is created, captured, and distributed across societies. American innovation will remain a central driver of this transformation, but its consequences will be negotiated in boardrooms and policy forums from New York and San Francisco to London, Berlin, Singapore, Seoul, and São Paulo. For the global readership of Business-Fact.com, staying informed about these developments is essential to making strategic decisions that are resilient, responsible, and aligned with the emerging contours of the 21st-century economy.