Finance in 2026: How Technology, Sustainability, and Regulation Are Redefining Global Money

Finance at a Turning Point

By 2026, the global finance sector has moved well beyond the early experimentation phase with digital tools and is now operating in a structurally different environment shaped by artificial intelligence, blockchain, embedded finance, and sustainability mandates. What began as isolated fintech disruption has matured into a complex, interconnected ecosystem in which banks, technology companies, regulators, and investors are all competing to set the standards of a new financial architecture. For the global audience of business-fact.com, which spans decision-makers in North America, Europe, Asia-Pacific, Africa, and South America, understanding this transformation has become essential not only for capital allocation and risk management, but also for strategic positioning in markets where financial innovation increasingly determines competitive advantage.

The post-pandemic years accelerated digital adoption, altered consumer expectations, and forced institutions to re-evaluate their operating models. At the same time, rising geopolitical tensions, inflation cycles, climate-related shocks, and rapid technological advances have made finance more central than ever to economic resilience. As readers who follow business and economy insights recognize, finance is no longer a passive reflection of macroeconomic conditions; it is an active driver of structural change, influencing employment, innovation, and industrial policy across the world.

Digital Transformation and Embedded Finance in 2026

Digital transformation in finance has evolved from a focus on online banking interfaces to a deep integration of financial services into everyday digital experiences. Embedded finance, once a buzzword, is now a mainstream reality across leading markets in the United States, Europe, and Asia. Platforms such as Shopify, Uber, and Apple Pay continue to expand their financial offerings, while newer ecosystems in regions like Southeast Asia and Latin America are using embedded payments, credit, and insurance to reach previously underserved populations. Readers who follow banking developments on business-fact.com see that the traditional notion of a bank as a standalone destination has been replaced by an "invisible finance" model, where services are accessed contextually at the point of need.

The underlying infrastructure for this shift is Banking-as-a-Service (BaaS) and open banking frameworks, supported by robust APIs and regulatory mandates such as the European Union's PSD2 and emerging open finance rules in the United Kingdom, Australia, Brazil, and other jurisdictions. Institutions like the Bank for International Settlements are closely monitoring these developments as they reshape competition and data flows. Learn more about how open banking is redefining financial access through resources from the European Banking Authority. Neobanks including Revolut, N26, and a growing cohort of regional challengers in Germany, the Netherlands, Singapore, and Brazil have built their value proposition on frictionless digital onboarding, real-time analytics, and multi-currency capabilities, forcing incumbents to accelerate their own digital roadmaps or partner with fintechs rather than compete head-on.

For corporate treasurers, SMEs, and founders who follow business and founders content on business-fact.com, embedded finance is not just a consumer story. It is changing how firms manage working capital, integrate supply chain financing, and design customer journeys. Retailers, software providers, and logistics platforms can now embed lending, BNPL (buy now, pay later), and insurance into their offerings, effectively becoming financial intermediaries without holding banking licenses, while regulated partners handle compliance and balance sheet risk.

Predictive Finance and the Maturation of AI

Artificial intelligence has shifted from experimental pilots to mission-critical infrastructure across banking, asset management, and insurance. In 2026, predictive finance systems draw on vast, real-time datasets to anticipate customer needs, optimize pricing, and dynamically rebalance portfolios. Institutions such as JPMorgan Chase and BlackRock have deepened their reliance on AI platforms like Aladdin, using machine learning models to monitor market risk, climate exposure, and counterparty vulnerabilities across global portfolios. Resources from the Bank of England illustrate how supervisors are scrutinizing these models for systemic implications as algorithmic decision-making becomes pervasive.

Robo-advisors and AI-enabled wealth platforms have expanded far beyond their early, low-cost ETF portfolio models. They now incorporate goal-based planning, tax optimization, and ESG preferences, making institutional-grade analytics accessible to retail investors in the United States, United Kingdom, Canada, Australia, and beyond. For readers tracking artificial intelligence and investment trends on business-fact.com, this democratization of analytics is reshaping competitive dynamics in wealth management, forcing traditional advisors to combine human judgment with AI tools rather than position themselves in opposition to automation.

At the same time, AI governance has moved to the forefront. Regulatory initiatives such as the EU Artificial Intelligence Act and guidance from organizations like the OECD and Financial Stability Board are pushing financial institutions to document model risk, mitigate bias, and ensure explainability in credit scoring, underwriting, and hiring. Professionals who rely on technology analysis understand that AI is no longer evaluated solely on performance metrics; it is assessed through the lens of fairness, accountability, and regulatory compliance, which directly affects reputational risk and long-term trust.

Blockchain, Crypto, and a More Regulated DeFi Landscape

Blockchain technology and digital assets have moved through cycles of exuberance, correction, and consolidation. By 2026, the crypto ecosystem is more regulated, more institutional, and more clearly segmented between speculative assets, infrastructure protocols, and regulated tokenized instruments. Major jurisdictions such as the European Union, through frameworks like MiCA (Markets in Crypto-Assets Regulation), and countries including the United States, Singapore, and the United Kingdom have clarified licensing, custody, and disclosure rules for exchanges and stablecoin issuers. The International Monetary Fund maintains a growing body of analysis on how these frameworks intersect with capital flows and monetary sovereignty, which can be explored via its digital money resources.

Decentralized finance (DeFi) platforms like Uniswap, Aave, and Compound continue to operate as permissionless protocols, but institutional engagement is now channeled primarily through compliant gateways, whitelisting mechanisms, and enterprise-grade custody solutions. Tokenization of real-world assets-ranging from commercial real estate in Germany and the United States to infrastructure debt in Asia and carbon credits in Europe and Africa-has become one of the most promising applications, enabling fractional ownership, enhanced liquidity, and 24/7 settlement. For entrepreneurs and investors following crypto coverage on business-fact.com, the emphasis has shifted from speculative trading to infrastructure, interoperability, and integration with traditional capital markets.

Central bank digital currency (CBDC) pilots have also moved closer to production in several major economies. The People's Bank of China continues to expand the digital yuan, while the European Central Bank and Bank of England have advanced their digital euro and digital pound projects. The Bank for International Settlements Innovation Hub has documented cross-border CBDC experiments that could significantly reduce friction in international payments. Learn more about these multi-CBDC initiatives via the BIS Innovation Hub. For readers who track global and economy insights, it is clear that digital currencies are no longer hypothetical; they are becoming tools of monetary policy, financial inclusion, and geopolitical strategy.

Sustainable Finance, ESG, and Climate Risk Integration

Sustainable finance has moved from niche to mainstream, driven by regulatory requirements, investor expectations, and the growing financial impact of climate-related events. Asset managers, banks, and insurers across the United States, Europe, and Asia-Pacific now integrate environmental, social, and governance (ESG) considerations into core decision-making. Initiatives such as the Glasgow Financial Alliance for Net Zero (GFANZ) and regulatory frameworks like the EU's Sustainable Finance Disclosure Regulation have compelled institutions to measure and disclose climate risks, financed emissions, and transition strategies. Resources from the Task Force on Climate-related Financial Disclosures have become standard references for both corporates and investors.

Green bonds, sustainability-linked loans, and transition finance instruments are now central to funding strategies for companies in sectors ranging from energy and manufacturing to real estate and transportation. Platforms like Bloomberg and Morningstar Sustainalytics provide increasingly granular ESG datasets, while supervisory bodies such as the European Central Bank and Bank of Japan have begun to incorporate climate scenarios into stress tests. For the sustainability-focused audience of business-fact.com, who regularly access sustainable business coverage, the message is clear: climate risk is investment risk, and financial institutions that fail to align with net-zero pathways face both regulatory penalties and market repricing.

In emerging and developing markets across Africa, South Asia, and Latin America, sustainable finance is also intertwined with development finance and just transition objectives. Institutions like the World Bank and International Finance Corporation are using blended finance structures to de-risk private investment in renewable energy, resilient infrastructure, and climate adaptation. Learn more about these blended finance models from the IFC climate business resources. For investors and policymakers, the integration of sustainability into finance is no longer a branding exercise; it is a prerequisite for long-term portfolio resilience and social license to operate.

Digital Assets, Tokenization, and the Future of Investment

Digital assets in 2026 encompass far more than cryptocurrencies. Tokenized securities, money market funds, real estate, and private equity interests are now being issued and traded on regulated digital asset platforms in jurisdictions such as Switzerland, Singapore, the United States, and the United Arab Emirates. Exchanges and infrastructures operated by organizations like Nasdaq and SIX Digital Exchange are experimenting with blockchain-based settlement systems that reduce counterparty risk and shorten settlement cycles. Insights from the World Economic Forum highlight how tokenization could unlock trillions in currently illiquid assets, particularly in private markets.

For institutional investors, the appeal lies in operational efficiency, programmability, and the potential to access new investor segments through fractional ownership. At the same time, the complexity of custody, valuation, and cross-border regulation demands specialized expertise. The readers of business-fact.com who monitor investment and stock markets recognize that digital assets are no longer peripheral; they are becoming an integral layer of the capital markets stack, coexisting with traditional instruments rather than fully replacing them.

Fintech Founders, Startups, and Regional Innovation Hubs

The innovation wave in finance continues to be propelled by fintech founders who operate at the intersection of technology, regulation, and customer experience. In 2026, the fintech landscape is more diverse geographically, with strong ecosystems not only in Silicon Valley, New York, and London, but also in Berlin, Paris, Singapore, Sydney, Toronto, São Paulo, Nairobi, Lagos, Mumbai, and Bangkok. Many of these hubs are supported by regulatory sandboxes from authorities such as the Monetary Authority of Singapore, the UK Financial Conduct Authority, and the Australian Securities and Investments Commission, which allow controlled experimentation with novel products. Learn more about regulatory sandbox models through the MAS fintech hub.

Startups are particularly active in areas such as cross-border payments, SME lending, regtech, insurtech, and financial inclusion solutions. In Africa and South Asia, mobile-first platforms inspired by pioneers like M-Pesa have extended basic financial services to millions of people who were previously unbanked. In Latin America, instant payment systems such as Brazil's Pix have catalyzed a wave of innovation in low-cost digital wallets and merchant services. For readers of business-fact.com interested in founders and innovation, these entrepreneurs are not simply building new apps; they are redefining how capital flows through economies and how individuals and small businesses participate in formal financial systems.

Cybersecurity, Digital Identity, and Trust

As finance has become more digital and more interconnected, cybersecurity has emerged as a defining concern for boards and regulators. High-profile ransomware attacks, data breaches, and fraud incidents have demonstrated that operational resilience is as important as capital adequacy. Organizations such as Mastercard, Visa, Microsoft, and leading cybersecurity firms are investing heavily in advanced authentication, network monitoring, and threat intelligence solutions. Guidance from the National Institute of Standards and Technology is increasingly used as a benchmark for cybersecurity frameworks across financial institutions in the United States and beyond.

Digital identity is a parallel priority. Biometric verification, e-KYC utilities, and government-backed identity schemes are being deployed to streamline onboarding while reducing fraud. The European Union's digital identity wallet, India's Aadhaar ecosystem, and Singapore's Singpass illustrate different approaches to balancing convenience, privacy, and security. For professionals who follow technology and banking updates on business-fact.com, it is evident that trust in digital finance rests on the strength of these identity and security layers. Without them, the benefits of embedded finance, open banking, and cross-border digital assets cannot be fully realized.

Employment, Skills, and the Changing Financial Workforce

The transformation of finance has profound implications for employment and skills. Automation and AI are reshaping roles in retail banking, operations, compliance, and trading, while creating new demand for data scientists, cybersecurity specialists, product managers, and ESG analysts. Studies from the World Economic Forum and OECD suggest that while net employment in finance may remain stable or grow modestly, the composition of roles is changing rapidly, with hybrid profiles that combine financial acumen, technological literacy, and regulatory awareness in highest demand. Explore broader future-of-work trends through the World Economic Forum's jobs reports.

For professionals who monitor employment and news on business-fact.com, this shift underscores the importance of continuous learning. Traditional qualifications must now be complemented by skills in areas such as machine learning, data engineering, cloud architecture, and climate risk analysis. Financial institutions in the United States, United Kingdom, Germany, Canada, Singapore, and other advanced markets are investing heavily in internal academies and partnerships with universities to reskill their workforce. Meanwhile, emerging markets are leveraging digital training platforms to build capacity in fintech, regtech, and sustainable finance, recognizing that human capital is a critical enabler of their financial innovation agendas.

Marketing, Customer Experience, and Financial Wellness

Marketing in finance has also undergone a strategic pivot. Rather than pushing products, leading institutions in the United States, Europe, and Asia now emphasize financial wellness, personalization, and lifetime value. AI-powered analytics allow banks and insurers to tailor messages, offers, and advisory content to individual behavior and preferences, delivered through mobile apps, messaging platforms, and even voice assistants. Organizations such as HSBC, Barclays, and digital players like Chime and Monzo are using gamification, nudges, and educational content to encourage savings, responsible credit usage, and long-term investing. For readers exploring marketing on business-fact.com, this evolution highlights how data and behavioral science are reshaping customer engagement.

At the same time, regulators such as the U.S. Consumer Financial Protection Bureau and the UK Financial Conduct Authority are scrutinizing digital marketing practices, particularly in areas like BNPL, crypto promotion, and influencer-driven financial advice on social media platforms. Learn more about consumer protection approaches via the FCA's digital marketing guidance. This regulatory attention reflects a broader shift toward treating financial well-being as a policy objective, not just a commercial opportunity.

Stock Markets, Market Structure, and Algorithmic Trading

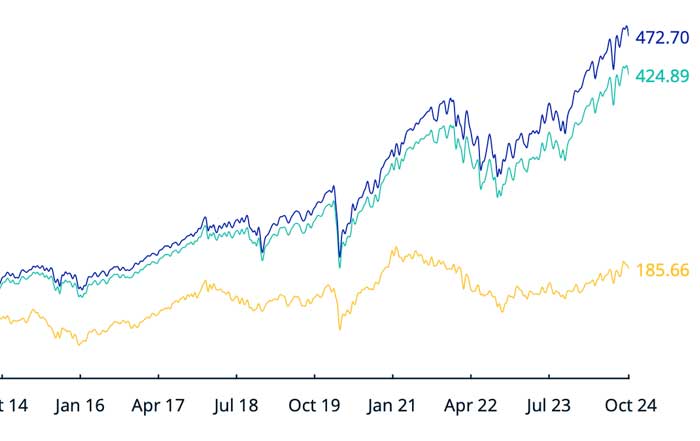

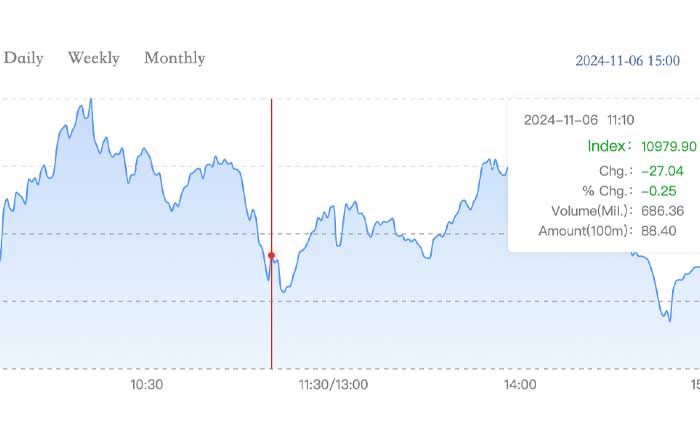

Global stock markets in 2026 are deeply intertwined with technology. High-frequency trading, algorithmic strategies, and AI-driven execution systems dominate volumes in major exchanges such as the New York Stock Exchange, Nasdaq, London Stock Exchange, Deutsche Börse, and Tokyo Stock Exchange. Post-trade infrastructure is gradually adopting distributed ledger technologies to streamline clearing and settlement, reduce reconciliation errors, and improve transparency. The London Stock Exchange Group's cloud and data partnerships with Microsoft and other technology providers exemplify how exchanges are repositioning themselves as data and analytics businesses as much as trading venues.

For investors and corporate leaders who consult stock market analysis on business-fact.com, these changes present both opportunities and risks. Liquidity is deeper and transaction costs lower, yet markets can react more violently to shocks as algorithmic strategies amplify momentum. Supervisors such as the U.S. Securities and Exchange Commission and the European Securities and Markets Authority are refining circuit breakers, market surveillance, and reporting requirements to mitigate flash crashes and manipulation. Learn more about evolving market structure from the SEC's market structure resources. The interplay between human oversight and machine execution has become a central theme in discussions about financial stability.

Global Divergence, Inclusion, and the Road Ahead

While advanced economies in North America, Europe, and parts of Asia lead in AI, tokenization, and capital markets innovation, some of the most impactful changes in human terms are occurring in emerging and developing economies. Mobile money, instant payment systems, and micro-lending platforms are expanding financial inclusion in Africa, South Asia, and Latin America, often leapfrogging legacy infrastructure. Initiatives documented by the World Bank's Global Findex database show how access to accounts, credit, and insurance is linked to improvements in entrepreneurship, resilience, and gender equality. Explore these inclusion trends through the World Bank's financial inclusion resources.

For the global readership of business-fact.com, spanning the United States, United Kingdom, Germany, Canada, Australia, France, Italy, Spain, the Netherlands, Switzerland, China, Sweden, Norway, Singapore, Denmark, South Korea, Japan, Thailand, Finland, South Africa, Brazil, Malaysia, New Zealand and beyond, the central insight is that finance in 2026 is no longer a discrete industry. It is a foundational layer of the digital economy, woven into commerce, labor markets, innovation ecosystems, and climate policy. Organizations that follow global, technology, and business updates on business-fact.com are acutely aware that strategic decisions about technology adoption, regulatory engagement, and sustainability positioning are now, by definition, financial decisions.

The sector's trajectory toward 2030 and beyond will be shaped by how effectively institutions balance innovation with governance, efficiency with inclusion, and profitability with long-term societal resilience. Those that build capabilities in AI, digital assets, sustainable finance, and cybersecurity, while maintaining a disciplined approach to risk and ethics, will define the next chapter of global finance.